Chinese Beer Industry Faces an Upgrade in Consumption

Young People is Losing Interests in Low-end Beer

The combination of beer and football always has wonderful chemical reactions. The FIFA World Cup is a grand event for football, and it is also the battlefield for major beer brands. After four consecutive years of declines in production and sales, the Chinese beer industry seems to have regained its vitality following the World Cup.

According to media reports, as early as one month before the beginning of the FIFA World Cup 2018, e-commerce platform Tmall prepared 100,000 tons of beer, which was 10 times the volume of the previous World Cup. During the same period, the search volume for the beer business increased by 100%. According to e-commerce platform JD‘s wine statistics, on June 18th, 500,000 tins of beer was sold in the first minute of the sales campaign.

However, unlike the previous boom in corporate mergers and acquisitions, price wars, and competitions for the markets, the current Chinese beer industry seems to have entered a rest period. The domestic beer has declined, while the imported beer is still advancing. This seems to imply that beer is stepping onto the road of high-end and diversity.

1. Chinese Beer Sales Have Fallen for 4 Consecutive Years

In recent years, the days of Chinese brewers seemed not easy. According to data from the National Bureau of Statistics, in 2017, the Chinese beer market completed a production of 44.01 million liters, a year-on-year decrease of 0.7%. This is the fourth consecutive year of decline in production and sales in the domestic beer market since 2014. Among the 447 beer companies, 132 of them had losses.

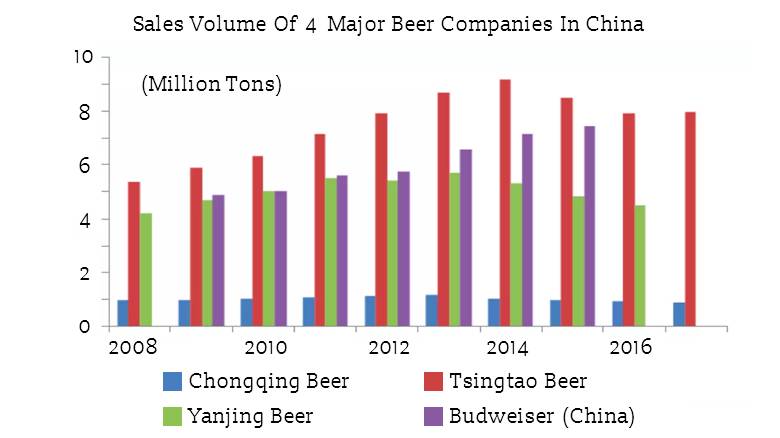

According to the sales data of several major breweries in the country for the past ten years, they basically experienced a process of increasing first and then decreasing. Tsingtao Brewery sold 9.15 million tons in 2014, reaching its peak in 10 years, and sales volume has been declining year by year. Yanjing Beer reached a sales peak of 5.714 million tons and Chongqing Beer 1.220 million tons in 2013. The changes in the overall market conditions are similar to the above companies. After the domestic beer market reached a record high in 2013, it began to decline and continued until 2017.

2. Chinese Beer’s Self-rescue: Close Factories After Mergers, Raise the Price After Price Wars

Due to poor performance of domestic beer consumption terminals, the strategy of continuous expansion till 2014 is no longer applicable. Since 2015, major beer companies have stopped expanding their production capacity and shut down small-scale, inefficient factories. Anheuser-Busch InBev shut down its factory in Zhoushan, and China Resources Beer closed 3 factories in 2015 and closed seven in 2016; Zhujiang Beer closed its Shantou factory producing low-end bottled beer in March 2017. Carlsberg closed 17 factories in China in 2016. And its Chongqing Brewery also closed down or sold some of its loss-making subsidiaries in 2014-2016.

At the same time, China Resources Snowflake, Tsingtao Brewery, Anheuser-Busch InBev and Yanjing Beer, the top four companies in China’s beer market share, announced price hikes earlier this year. Yanjing’s 460ml Bun beer retail price rose 1 yuan/bottle. China Resources Snowflake’s pure, draft beer and other products’ price rose 2-10 yuan/bottle. Tsingtao Beer also issued a price increase letter to the dealer. Overall, the collective price increase ranged from 5% to 15% during this period.

This is the first collective price rise in the Chinese beer industry since last wave of price increases in 2008. Beer companies attributed the price increases to costs. And in the industry’s view, beyond cost, after years of price wars and mergers and acquisitions in the industry, the Chinese beer industry is already a meager industry, especially in the low-end market. This round of price increases is undoubtedly a historical debt.

3. Fewer and Fewer People Drinks Beer

With the advancement of the aging process of the domestic population, the proportion of the beer-consumer has continued to decline. And the demographic dividend has gradually disappeared. The apparent increase in sales has been unrealistic. According to statistics, the proportion of the main beer consumer groups aged between 20 and 50 years old in China has fallen to 48.57% in 2017, which is a decrease of 3 % from 2011. Calculated by considering Chinese huge population base, the main consumer groups are reduced by about 40 million people. Taking China’s current per capita beer consumption of 37 liters, the overall domestic beer market demand in 2011-2017 had reduced by 1.48 million tons.

On the other hand, the number of blue-collar workers who are the main force in beer consumption has also declined. The reduction in the number of workers has gradually reduced the sales of blue-collar-based categories like beer and instant noodles.

At the same time, Chinese per capita beer sales have exceeded the world average. According to the data of the China Alcoholic Drinks Association, the current average per capita beer consumption in China is about 37L per year, which is higher than the world average of about 33L per year. In the long run, domestic beer consumption in China will enter a period of slow development.

Consumption upgrade is one of the main factors that lead to the above phenomenon. On the one hand, the idea that domestic beer has been used to attract consumers with low prices and good quality has been weak. With the improvement of consumer economic capacity and changes in consumption outlook, they are now more inclined to buy higher-end beer. On the other hand, emerging low-alcohol products have developed rapidly in recent years. They are getting more and more popular in younger groups.

4. How to Upgrade the Chinese Beer Consumption

High-end Beer Market

Low-end beer continued to slump, while high value-added beer showed a relatively rapid growth. In 2011-16, the proportion of high-end beer sales increased from 15.9% to 25.3%. And the market share increased from 38.4% to 57.4%. According to Euromonitor’s prediction, by 2020, the proportion of the sales income of high-end, mid-end and low-end beer will be 44.2%, 28.3%, and 27.5%.

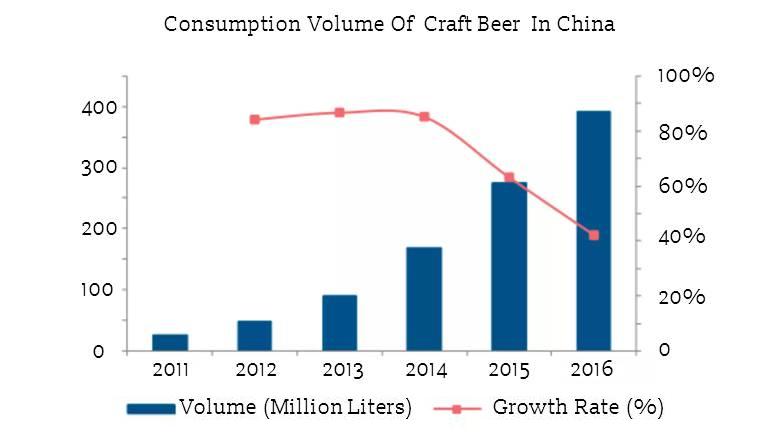

According to incomplete statistics, China Resources, Tsingtao, Yanjing, Budweiser, and Carlsberg have all deployed their products in the mid-end and high-end markets of over RMB 10. However, from the current point of view, the effect of the high-end line of domestic brands is not obvious. The sales growth of imported beer has remained at 50% to 80% for five consecutive years from 2012 to 2016. This has occupied the market share of domestic beer companies.

In addition, the small and beautiful craft beer has achieved a good performance. The reason is that it satisfies consumers’ demand for health, diversity, and personality by virtue of its rich variety.

Therefore, brewers have started to build their high-end roads in various ways, including high-end bottle design, high-end publicity methods (such as advertising LCD Coolers) to attract more young consumers.

Updates of The New Generation of Consumer Scene

Unlike liquor consumption, beer has to increase its sales to capture the market by creating a readily available consumption scenario. One of the important reasons why young people prefer beer is to use it as a social drink to maintain a relaxed and happy social atmosphere, instead of simply drinking alcohol to get drunk. Secondly, from the perspective of consumption, in the gathering of family or friends of young groups, there are more mixed scenes for men and women. And the requirements for product diversity (especially for women’s beer) are even more prominent. At this time, through the introducing of new categories, the consumption habits of important young groups can be satisfied. Personalized and fashionable product concepts can meet the young consumers’ emotional value proposition, and cultivate their long-term consumption habits.

Alternative Products for Beer

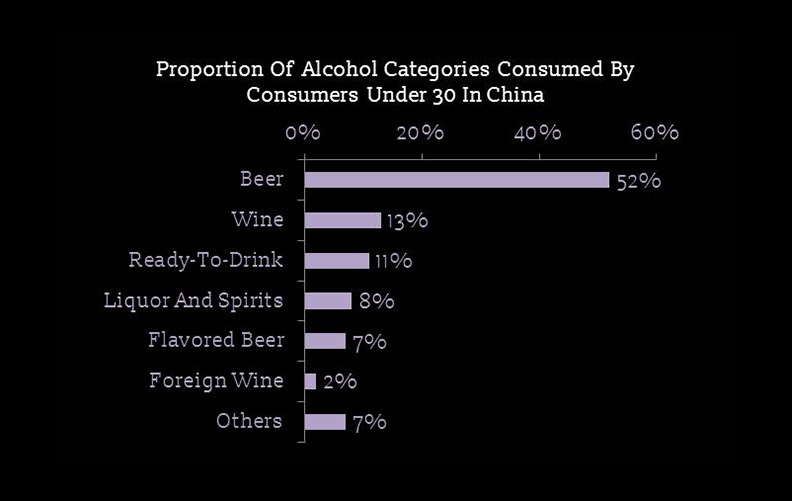

With the rising of consumer health awareness and improvement of consumption structure, traditional beer is less attractive to consumers. Emerging low-alcohol beverages have become alternatives to beer. According to the history of beer development in the United States, the beer consumption of younger groups aged 18-29 years has declined significantly and has been replaced by wine and alcoholic beverages.

Compared with the decline of traditional beer, imported high-end beer and emerging low-alcohol products (pre-mixed drinks, fruit wine) develop rapidly. This becomes one of the few bright spots in the overall market downturn.

At the same time, many giants in the beverage industry have also sold their wine across the border. For example, Starbucks and Coca-Cola have also launched alcoholic beverages.

And some beer brands have launched non-alcoholic beer. According to Reuters, the sales of European non-alcoholic beer have increased by 5% every year from 2010 to 2015. In Asian countries such as Japan, although the shipments of beer categories (traditional beer, foamed beer, and third beer) fell for 12 consecutive years, non-alcoholic beer bucked the trend: In 2016, the sales of non-alcoholic beer by 4 major brewers, Suntory, Asahi, Kirin, and Sapporo increased by 1.8%. Women and young consumers particularly favor this category of beer.

In the past, the main consumers of non-alcoholic beers were those who could not drink alcohol such as pregnant women and drivers. Now, more and more people want to have a healthier lifestyle and reduce their alcohol consumption.

New Demands By New Generation

Finally, young consumers born in the 1980s and 1990s become the major consumer power of the market. The huge population and significant differences of the growth environment from other ages make them a very special consumer group. They have also set off revolutions in many industries. For example, in the apparel industry, the tendency to focus on trends and personalization of “fast fashion” rises. In catering industry, the “new type of catering” that focuses on product features and personalized consumer experience continues to emerge. In the beverage industry, companies are providing product choices that meet consumers’ diet plans or modify their current moods. The younger groups’ pursuits of diversity, individuation, convenience and new changes also have a profound impact on the consumption of the Chinese beer industry.