China’s Packaged Drinking Water Sales and Prices Rise in 2017

High-end, Family Consumption Scenarios Are Growth Drivers

Recently, Nielsen released the latest research of the packaged drinking water industry. Nielsen’s research shows that in 2017, both the sales revenue and volume of Chinese packaged water achieved double-digit growth. This is leading the overall growth trend of the food and beverage industry.

According to the Nielsen study, in 2017, the drinking water category achieved a double-digit growth of sales revenue of 17% and sales volume of 15%. Among them, sales volume of high-priced water which is more than RMB5 / Liter increased by 20%.

The strategy of high-end products of packaged drinking water

The Nielsen study found that more than half of consumers believe that high-end products need to be prepared with “high-quality raw materials” (53%) and “excellent functionality” (51%). Also, nearly 50% of consumers have a demand for “superb design”.

The natural source of water and affinity are the main selling points of high-priced water in the market. In terms of product packaging, the material must be textured, the layout of the bottle must be simple, and the artistic sense of the screen is an essential element.

In recent years, the refreshing sparkling water and the packaged drinking water with fresh fruit flavor (lemon, mint, and lime) also showed strong growth momentum and market premium. Among them, the sales volume of water with fresh fruit flavor grew by as much as 52%. And the sparkling water’s premium capacity could reach 7.5 times. In addition, establishing emotional connections with consumers can also effectively promote product sales.

The Nielsen study found that a good connection between emotional expression and functional benefits can help grow the sales.

The strategy of organic growth of packaged drinking water

The increase in sales of large packaged drinking water driven by household consumption and the similar sales channels have boosted the organic growth in sales of packaged drinking water. This is a strong growth driver for packaging water industry. And we can see that in all sizes of drinking water.

From the perspective of product packaging dimensions, 401-800ml cartridges still dominate the market. At the same time, 2L or larger packaging has grown rapidly. The potential to leverage large packaged drinking water in various scenarios is the main driving force behind the continued rapid growth of large drinking water. By providing brackets, spouts, and handles for large packaged drinking water, creating a facile product experience, and approaching sales channels are the primary strategies for manufacturers to develop large packaged water.

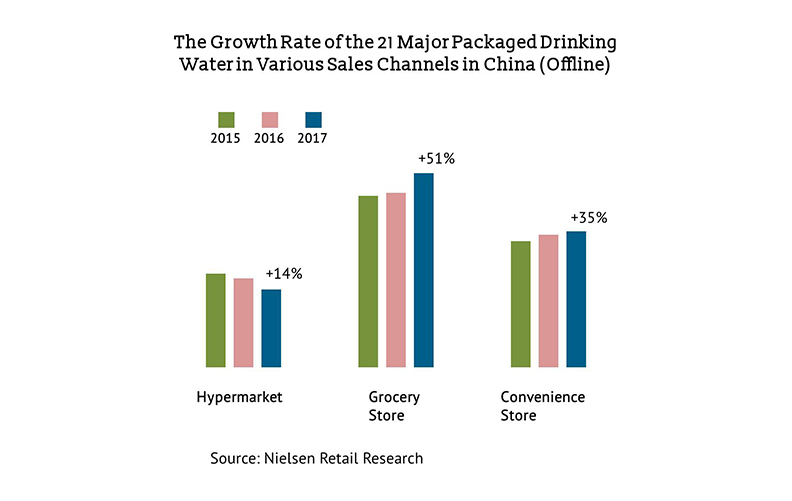

From the perspective of sales channels, grocery stores, as the dominant channel, accounted for 65% of the total sales in the packaged drinking water market, and grew well. Although the current market share of the convenience store is only 9%, its growth rate is as high as 22%. And its development momentum cannot be underestimated.

Through comparison with modern small-scale channels, the contribution rate of single-package sales of single stores in grocery stores has double-digit growth. While the single-item quantity in single stores is still not saturated. It indicates that packaged water has greater growth opportunities on grocery stores. And the improved display of grocery products may further increase sales of packaged drinking water at grocery stores.